marin county property tax exemptions

The voters approved this parcel tax in March 2020 by approximately 71 for a period of ten years starting with the 202021 fiscal year. Virtually every school district offers parcel tax exemptions for seniors 65 and older and often for low income and disabled taxpayers as well.

Property Tax Re Assessment Bubbleinfo Com

Single Family Residential - Improved.

. Please contact the districts. The individual districts administer and grant these exemptions. 3501 Civic Center Drive Suite 208.

Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes. Qualifying for Senior Exemptions. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

This would result in a savings of approximately 70 per year on your property tax bill. Marin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Some of the deadlines have already passed but many jurisdictions are still accepting applications for fiscal 2021.

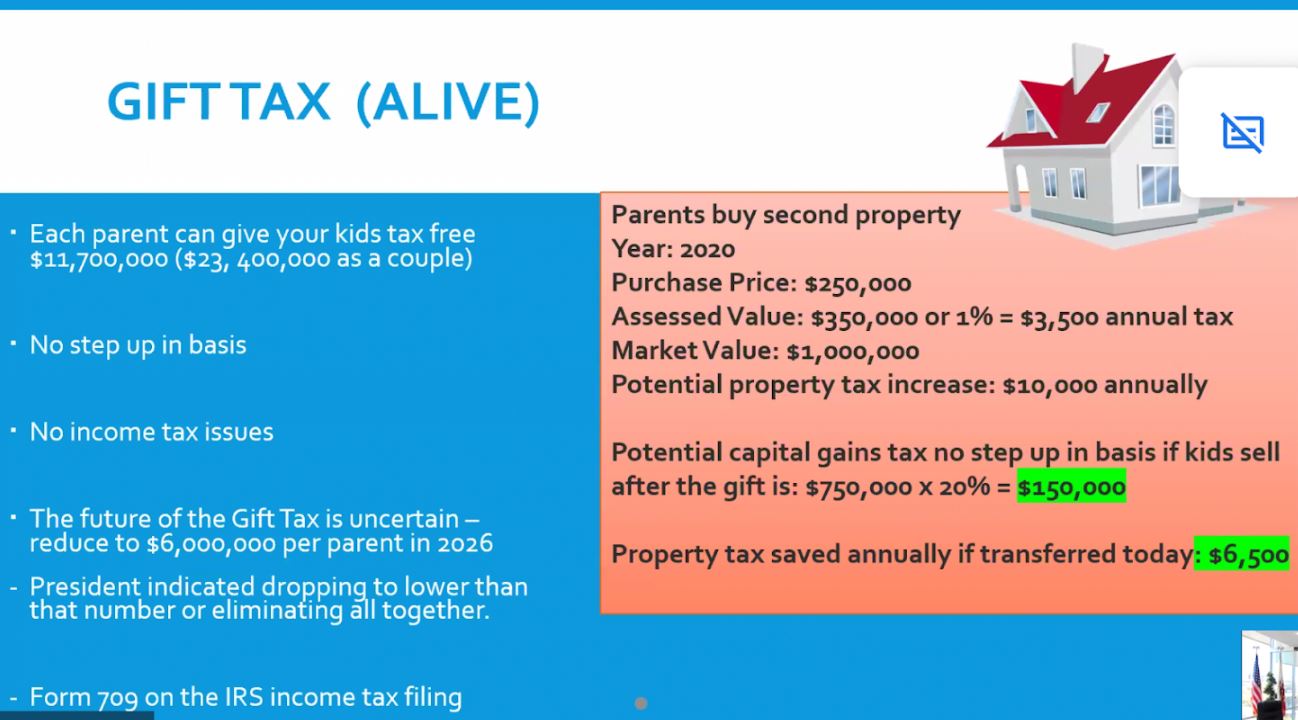

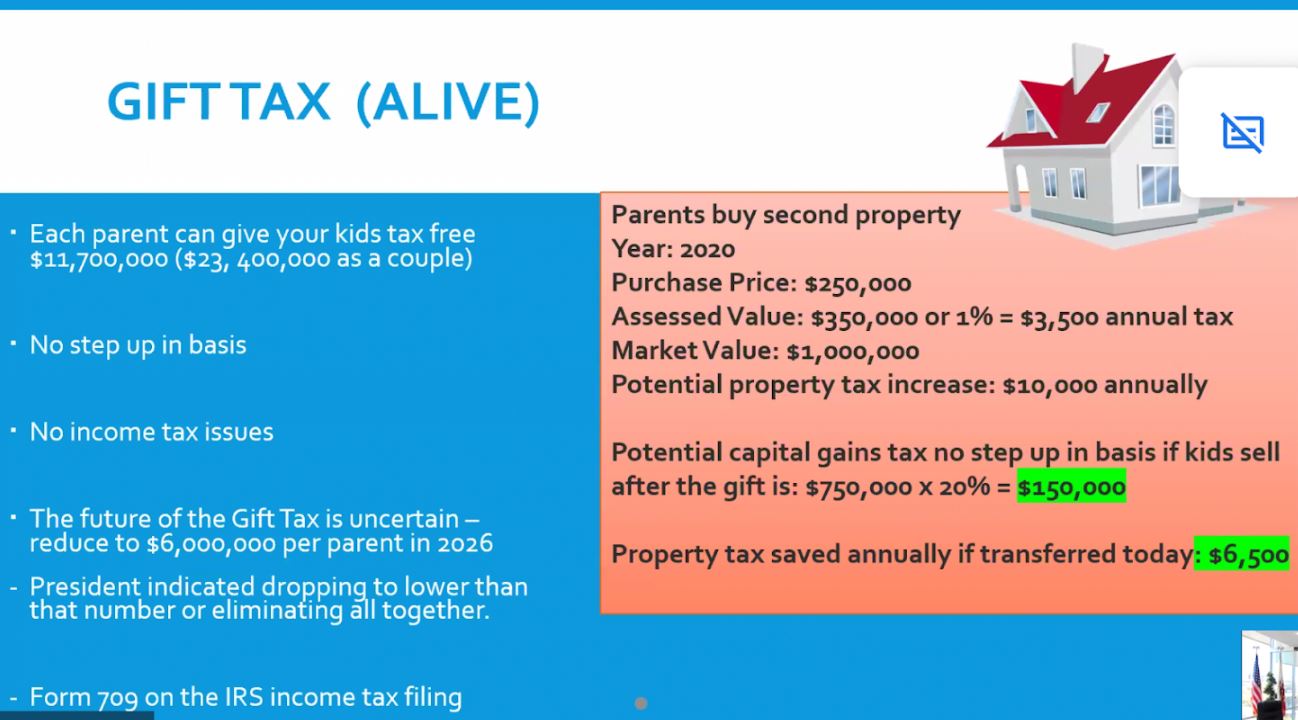

This exemption is popularly known as the welfare exemption and was first adopted by. Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house. Ad Find Marin County Online Property Taxes Info From 2021.

For example the property taxes for the home that you have owned for many years may be 3500 per year. To claim the exemption the homeowner must make a one-time filing with the county assessor where the property is located. They all are legal governing units managed by elected or appointed officers.

To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single-family residence located in the Measure A tax zone of the Marin County Free Library District. Learn About Your Senior Exemptions. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

Community Services Fund Program. The county provides a list of exemptions for property tax items that apply tour property. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria.

County of Marin Job. Transfer tax in Marin County is a tax imposed by California counties and cities on the transfer of the title of real property from one person or entity to another within the jurisdiction. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

The home must have been the principal place of residence of the owner on the lien date January 1st. The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you.

Accessory Dwelling Units External Business License. The Assessors Office is available by phone at 415 473-7215 or via email. Taxing units include city county governments and various special districts such as public schools.

In-person assistance is available on a limited basis. Marin Countys Property Tax Exemption webpage has a. If the application is filed between.

To qualify for a senior low-income exemption you must be 65 years or older. Time is short to submit applications for exemptions and discounts on an array of parcel taxes and agency fees. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens.

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. San Rafael California 94903. Please use our appointment calendar to schedule your appointment with the Real or Personal Property divisions of the Assessors Office.

Taxes and assessments section provides detailed information on new tax information exemptions and exclusions that are available and information on how to have your home or property reassessed. Exemptions to Transfer Tax in Marin County. Property Tax Relief Assessment.

If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. Get driving directions to this office. And file the homeowners exemption claim form with the Marin County Assessors Office by February 15th.

The Legislature has the authority to exempt property 1 used exclusively for religious hospital or charitable purposes and 2 owned or held in trust by nonprofit organizations operating for those purposes. Overall there are three stages to real estate taxation. While income-based discounts require annual.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. Non- Profit Charitable 501 c 3 Exemption. Senior and Low Income Parcel Tax and Fee Exemptions APPLY NOW.

The individual districts administer and grant these exemptions. Searching Up-To-Date Property Records By County Just Got Easier. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization.

Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June 30th. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. This section also provides direct links to downloadable and printable forms to help file your property taxes.

Veterans Exemption Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home. Benefits and Job Assistance. Some states specify exemptions such as a sale resulting from a divorce or death a transfer from parent.

Delinquent Court Fines and Fees. Establishing tax levies estimating property worth and then receiving the tax. The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home.

415 499 7215 Phone 415 499 6542 Fax The Marin County Tax Assessors Office is located in San Rafael California.

For Seniors Keeping Your Property Taxes Low

Property Tax Bills Arriving In Mailboxes Soon

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

What Is A Homestead Exemption California Property Taxes

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Homes Frank Lloyd Wright Architecture Building

Property Tax Bills On Their Way

Transfer Tax In Marin County California Who Pays What

California Property Taxes Viva Escrow 626 584 9999

For Seniors Keeping Your Property Taxes Low

The Property Tax Inheritance Exclusion

Property Tax Exemption For Live Aboards

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Marin Residents Have Until Monday To Pay Property Taxes

Understanding California S Property Taxes

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing